Oligopoly is in!

Burbank, California; June 1999; Joan Marques, MBA

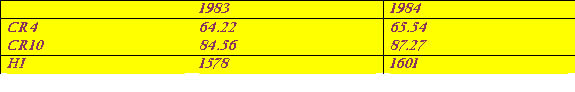

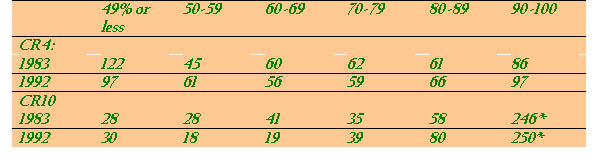

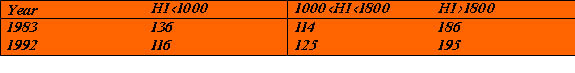

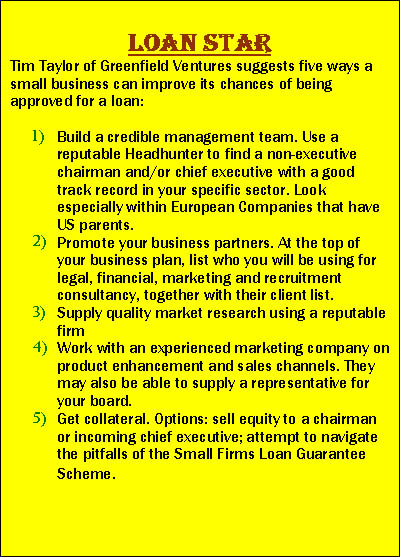

Oligopoly, the structure with a few relatively large firms that control the market, remains the trend, locally and globally. In cigarettes, cars, softdrinks, music, telecommunications, airlines (see annex for charts and Indexes): in almost every market we see a few giants surviving time and changes. According to John Cavanagh, director of the Institute of Policy Studies, Oligopolistic developments are not good for consumers, no matter what the Oligopolists say . Yet, even if the Government breaks up a market, it is a matter of time before Oligopoly regenerates. The U.S. Telephone Business shows a similar pattern: Four giants rule this market. After the break-up of AT& T?s monopoly by the Justice Department, followed by a period of ?chaotic competition ?, the following companies mainly cover the United States: AT&T, MCI World Com Inc., SBC Communication Inc. and Bell Atlantic Corp. Each of them has accomplished a great number of acquisitions, horizontal, and vertical mergers to gain their current position. AT&T, for instance, formed an alliance with Time Warner Inc.?s cable unit; which will enable them to offer local phone service to 40% of the U.S. At the same time, AT&T buys all available cellular phone-companies and licenses to increase power in this field. To my opinion this oligopoly shows strong resemblance with the Stackelberg model, where there is one ?leader?(AT&T), choosing an output before the rivals do (see annex). Some see these mega-mergers as positive. Reed Hundt, former chairman of the Federal Communications Commission says consumers will be better off. ?There will be multiple national carriers, a handful of local regional operators, great variety and tremendous creativity in marketing,? he predicts . Others worry about the great number of customers that won?t be served once these few giants will decide which customers they want and which not. In rural areas there are only two companies who deliver telephone service against a very low rate, while the Government subsidizes the costs. This model supposedly represents a Bertrand Oligopoly, in which firms operate at a constant marginal cost. Even though price fixing is forbidden in the U.S., it is quite common in Europe and Japan. In the U.K., for instance, banking oligopoly causes the majority of Small and Medium-sized Enterprises (SME?s) to remain small. The banks, in their strong Oligopolistic position, demand immense securities from SME?s for loans, while overcharging them and setting inappropriate high interest rates. Bank-representatives insist that the policy of the U.K. banks has become more flexible lately, but the SME?s know better. And even though Tim Taylor, managing director of Greenfield Ventures developed a ?loan Star? Theory (see annex) for SME?s to increase their loan-chances, the Institute of Director?s (IoD) business policy executive, Richard Wilson, doubts whether this will make much difference to small firms . Another well-known oligopoly in the UK is the grocery-chain in which 4 members account for between 45% and 67% of the country?s $150 billion grocery market . The concentration rate depends on the way it is looked at. Companies are likely to view themselves in a broader sense than regulation institutes are willing to do, just to lower the percentage of their market-share. In this Oligopoly, that seems to be a Sweezy-type to my opinion, since prices are high and inflexible, everything is done to prevent new entries. Recently American Warehouse Clubs tried to get a foothold in the UK, but the food retailers joined forces and prevented such . The big grocery chains are trying to maintain their position through big donations to the ruling ?Labour Party? during the last election. Yet, according to this article, it is more than likely that they will either have to lower their prices themselves, or the Government will do it . Japan is also regarded a highly concentrated market. U.S. Government and private business groups call for deregulation as well as the strengthening of antitrust laws in Japan. Using the 4-firm (C4) and 10-firm (C10) concentration ratio and the Herfindahl Index (HI), we see that between 1983 and 1992 Japanese economy proves highly Oligopolistic (see annex). This has been the case in Japan since the fifties. Research has proven that changes in concentration are positively related to output growth and scale economies, and negatively correlated with market size. It is further proven that Japanese Industries, which are least price-competitive and more protected by Government from domestic as well as foreign competition, experience greater increase in concentration than competitive industries during this period . In Hong Kong the Government is even participating in Oligopolistic enterprises!

Members of the political coalition as well as the opposition are important cartel-members: from the stock market, which is the world?s fifth biggest , to Real Estate, in which the Government has great financial interest. Cartels, Duopolies and Monopolies dominate banking, telecommunications, television and even supermarket -industry in Hong Kong. Martin Lee, a prominent opposition leader, awkwardly admits: ?We don?t have a free market here? But no matter how hard the American government tries to control market concentration, percentages and bare numbers still show us an increasing Oligopolistic trend in the U.S.:

That Oligopoly is also Globally perceivable is proven by the entertainment industry. Through decades leading companies have come and gone. The changes in technology caused them to either vanish or turn into giants. Entertainment nowadays consists of 7 huge world-companies: Time Warner, Walt Disney, Bertelsmann, Viacom, News Corp, Seagram and Sony. (3 U.S., 1 Australian, 1 Canadian, 1 German, 1 Japanese) . It is the same picture we saw in the oil- and automotive business. Time will tell who will grow and who will disappear?

Beverages: The Big Three

HHI = 10.000 [ (44.5/90.3) + (31.4/90.3) + (14.4/90.3)] = 3,892 (Highly concentrated.)

Source: Martin Feldman & Salomon Smith

HHI= 10.000 . [(80/171) + (41/171) + (30/171) + 20/171)]= 3,208 (Highly concentrated.)

Source: Companies

Oligopoly in Japan:

Weighted Average Concentration Ratio and HI (163 industries)

Source: Calculated from Japan FTC, Production Concentration and Herfindahl Indexes for Major Industries, September 1986 and June 1995, and Japan Statistics Bureau, Japan Statistical Yearbook, 1985 and 1995.

Number of Industries stratified according to the level of concentration

Source: Japan FTC, Production Concentration and Herfindahl Indexes for Major Industries, various issues * Includes Industries whose CR reached 100 before the 10-firm level.

Source: Japan FTC, Production Concentration and Herfindahl

Uncombined: modest Market Share

Combined: Highly concentrated!

FILM DISTRIBUTORS (GLOBAL OLIGOPOLY)

References:

Wall Street Journal- March 8, 1999- “Big Business: Let’s Play oligopoly! --- Why Giants Like Having Other Giants Around.l.6-7 Wall Street Journal- March 8, 1999- “Big Business: Let’s Play oligopoly! --- Why Giants Like Having Other Giants Around. P.2 , al. 6. Wall Street Journal- March 8, 1999- “In Phones, the New Number is Four”. P.1.l.3 Wall Street Journal- March 8, 1999- “In Phones, the New Number is Four”. P.1.l.5 Wall Street Journal- March 8, 1999- “In Phones, the New Number is Four”. P.2.l.5-6 Wall Street Journal- March 8, 1999- “In Phones, the New Number is Four”. P.2.al.7 Wall Street Journal- March 8, 1999- “Big Business: Let’s Play oligopoly! --- Why Giants Like Having Other Giants Around. P.3, al.3. Director, May 1999, “Crying all the way from the bank”- p.5, al.4. Forbes, Dec. 14, 1998, “Squeezed Lemons” – p.2, al.6. Forbes, Dec. 14, 1998, “Squeezed Lemons” – p.2, al.4. Forbes, Dec. 14, 1998, “Squeezed Lemons” – p.3, al.4. International review of Applied economics; May 1998, “Trends in Industrial Concentration in Japan” – p.1, al.1. International review of Applied economics; May 1998, “Trends in Industrial Concentration in Japan” – p.5, al.5 - p.6, al.1. Wall Street Journal; Sep. 14, 1998, “Hong Kong’s Free Market Image Belied by Oligopolies --- Government Aided Rising Values, Too”, p.2, al.2. Wall Street Journal; Sep. 14, 1998, “Hong Kong’s Free Market Image Belied by Oligopolies --- Government Aided Rising Values, Too”, p.2, al.2. Wall Street Journal; Sep. 14, 1998, “Hong Kong’s Free Market Image Belied by Oligopolies --- Government Aided Rising Values, Too”, p.3, al.9. Multinational Monitor, Nov, 1998, “Oligopoly!: Highly concentrated markets across the U.S. economy”, p.1, al.2. Multinational Monitor, Nov, 1998, “Oligopoly!: Highly concentrated markets across the U.S. economy”, p.1, al.2.al.7, p.3, al.1. The economist, Nov. 21, 1998, “Technology and Entertainment: Wheel of Fortune”, p.2, al.5.