Luke 16:13 No servant can serve two masters: for either he will hate the one, and love the other; or else he will hold to the one, and despise the other. Ye cannot serve God and mammon. Revelation 18:23 for thy merchants were the great men of the earth; for by thy sorceries were all nations deceived.

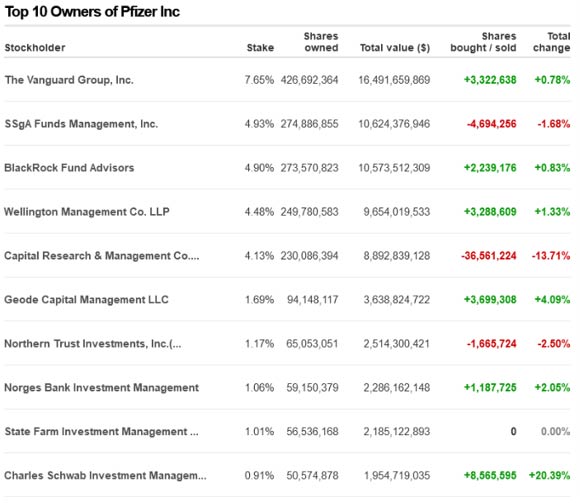

The Vanguard Group is one of the largest asset management corporations in the world, and it’s the top shareholder of Pfizer, along with BlackRock, another gigantic asset management company.

The Vanguard Group is based in Pennsylvania, which seems to be a Jesuit stronghold, as I showed a couple years ago. And the corporation is apparently controlled by the Jesuits, as 5 of its 11 managing directors are Jesuit trained;

Pfizer’s, which has made massive profits with the coronavirus plandemic, top insider shareholder is Frank D’Amelio, who served as its CFO from 2007 to 2021. D’Amelio has a B.S. from Saint Peter’s University, the Jesuit university in New Jersey, and a M.B.A. from St. John’s University, a Catholic Vincentian university in New York City.

[Saints, I would add Scott C. Malpass with ties to Vanguard Group to the list. Catholic Investment Pioneer, Finance Innovator, Counselor to Vatican Bank - Scott C. Malpass is the former Vice President and Chief Investment Officer of the University of Notre Dame, and the Managing Partner and Co-Founder of Grafton Street Partners, L.P. Under Malpass’s leadership, the Notre Dame endowment pool grew from $400 million in 1988 to $15 billion as of June 30, 2020. Over Malpass’s 32 years of leadership, the Notre Dame Endowment achieved investment performance ranking amongst the top 1% of endowments globally, transforming opportunities at the University in all aspects of academic and student life. He is currently a member of the Board of Directors of The Vanguard Group, Paxos Trust Company, and Catholic Investment Services, Inc. He is also a member of the Board of Superintendence of the Institute for the Works of Religion in Vatican City, commonly referred to as the Vatican Bank. Malpass is a 1984 graduate of Notre Dame and received a Master of Business Administration degree from the University in 1986.]

As a reminder, there are 27 colleges and universities in the USA that belong to the Association of Jesuit Colleges and Universities (AJCU). These are places through which the Jesuits build up their influence in America by indoctrinating future leaders and societal influencers, and they’re also great places to recruit willing Jesuit coadjutors, or Jesuit agents, who will further their globalist, anti-American, anti-protestant agenda.

Two of the largest asset management companies, BlackRock and Vanguard, own both Big Pharma and the media

Ethan Huff - Citizens News

If you have ever wondered why television “news” is constantly interrupted by advertising for the latest drug offerings from Big Pharma, look no further than Blackrock and Vanguard, two of the world’s largest asset management companies, which just so happen to own both the drug industry and the media.

BlackRock and Vanguard are currently the top two owners of Time Warner, Comcast, Disney and News Corp. These four media conglomerates own and control more than 90 percent of the United States media landscape, which explains why their collective coverage of world events all centers around the same propaganda. Though most people have never heard of them, BlackRock and Vanguard are also the silent monopoly owners of many other facets of the economy. They are said to hold ownership in some 1,600 American firms which, as of 2015, held combined revenues of $9.1 trillion. If you add in State Street, BlackRock and Vanguard also have a stake in nearly 90 percent of all S&P 500 firms. Vanguard is also the largest shareholder of BlackRock – Vanguard having direct links to many of the world’s oldest and richest families.

If the name BlackRock sounds familiar as of late, that is because this entity is also gobbling up real estate, usually at well over asking price. This is a big reason why real estate prices are the highest they have ever been. “This is wealth redistribution, and it ain’t rich people’s wealth that’s getting redistributed,” tweeted the account @APhilosophae. “It’s normal American middle class, salt of the earth wealth heading into the hands of the world’s most powerful entities and individuals. The traditional financial vehicle gone forever.” What this means is that BlackRock and Vanguard together own pretty much everything there is to own, which explains why everything is now moving in one general direction, straight towards a Great Reset.

No matter the industry or the sector, BlackRock and Vanguard more than likely hold a stake and control the movement. “The stock of the world’s largest corporations are owned by the same institutional investors. They all own each other,” one resource explains. “This means that ‘competing’ brands, like Coke and Pepsi aren’t really competitors, at all, since their stock is owned by exactly the same investment companies, investment funds, insurance companies, banks and in some cases, governments.”

What about the smaller investment companies, you might be asking? Those, too, are owned by larger investment companies like BlackRock and Vanguard, which sit at the top of the financial pyramid. “The power of these two companies is beyond your imagination,” the aforementioned resource goes on to explain. “Not only do they own a large part of the stocks of nearly all big companies but also the stocks of the investors in those companies. This gives them a complete monopoly.” “A Bloomberg report states that both these companies in the year 2028 together will have investments in the amount of $20 trillion. That means that they will own almost everything.” The following video has more:

In truth, BlackRock and Vanguard are one and the same, seeing as how the latter is the largest shareholder of the former. Among the family names tied into the two are the Rothschilds, the Bushes, the British Royal family, the Du Ponts, the Vanderbilts and the Rockefellers. All of these families have been pushing for a New World Order for centuries, and it would appear as though they are on the verge of achieving their goal through the destruction of world financial systems, the gobbling up of all real estate, and eventually the total abolition of private property. Soon, everything will be owned by this handful of wealthy families via their financial terrorism mechanisms, which include funds like BlackRock and Vanguard that are quickly vacuuming up all of the world’s resources.

Big Pharma is another huge part of this process, as the industry continues to pump out drugs and vaccines that are dumbing down the masses and making them more compliant with this grand takeover. According to Simply Wall Street, in February 2020, BlackRock and Vanguard were the two largest shareholders of British drug giant GlaxoSmithKline (GSK). Pfizer, the creator of one of the two mRNA “vaccines” for the Wuhan coronavirus (Covid-19), is also largely owned by BlackRock and Vanguard. As we have seen throughout the past year, the Chinese Virus “pandemic” was the vehicle needed to deliver the final death blow to the world economy. Many small businesses were forced to close forever, while large corporations owned by BlackRock and Vanguard thrived like never before. This was not an accident and was all built in to the plandemic agenda, which was hatched long ago as a means through which to steal the rest of the world’s remaining resources and place them in the control of the “elite.”

To keep everything on track, the media, which is also owned by BlackRock and Vanguard, has been towing the line to keep ordinary people from figuring out what is actually going on until it is already too late. We are almost at that point now as America’s financial system teeters at the brink of no return, which is no accident and was planned for such a time as this. “Importantly, BlackRock also works closely with central banks around the world, including the U.S. Federal Reserve, which is a private entity, not a federal one,” warns Dr. Joseph Mercola. “It lends money to the central bank, acts as an adviser to it, and develops the central bank’s software.”

According to Simply Wall Street, in February 2020, BlackRock and Vanguard were the two largest shareholders of GlaxoSmithKline, at 7% and 3.5% of shares respectively. At Pfizer, the ownership is reversed, with Vanguard being the top investor and BlackRock the second-largest stockholder.

BlackRock and Vanguard Own the World