---

---

DUCKS UNLIMITED

The Jekyll Island off Georgia's

coast collaborators knew that public reports of their meeting would scupper

their plans. The idea of senior officials from the Treasury, Congress, major

banks and brokerages (along with one foreign national) slipping off to design a

new world order has struck generations of Americans as distasteful at best and

undemocratic at worst -- and would have been similarly received at the time.

So the meeting of the minds was planned

under the ruse of a gentlemen’s

duck-hunting expedition.

Ducks Unlimited is essentially a Washington DC lobby

group that somehow gets entangled with many Army Corps of Engineers wetlands

deals, involving unknown secrecy-laced MITIGATION BANKS, and developers. A lot of the ‘duck hunters’ who work in the

DC lobby headquarters are rich Republican types whose “ancestors came to

America on the Mayflower, at Plymouth Rock”, etc. Remember when Dick Cheney shot up with buckshot

[“peppered”] in 2006 his Texas bird hunting friend, Harry Whittington, another privileged

white shoe attorney?

Texas lawyer shot in the face by Dick Cheney apologizes to Cheney on national news for stupidly putting his head in the nozzle of the former Freemason Grandmaster's shotgun!

In November 1910, in the space of less

than two weeks, a group of government and business leaders fashioned a powerful

new financial system that has survived a century, two world wars, a Great

Depression and many recessions.

Of course, the Jekyll Island

conference, which met that month, was dodgy even by the standards of the

Gilded Age: a self-selected handful of plutocrats secretly meeting at a

private resort island to draw up a new framework for the nation’s

banking system.

Aldrich, an archetype of his age, was a

personal friend of Morgan, and Aldrich's daughter was married to John D.

Rockefeller Jr. He found in the Rothschild European central banks a useful

model. Although the financial system in the U.S. was functional enough to stoke

the engines of a growing industrial economy, it was a classic example of the

persistence of interim solutions. The models Aldrich found in Rothschild run

Europe were more efficient and effective.

What he lacked was a way to graft those

characteristics onto the American economy without retarding it.

Hence the duck hunt.

Aldrich

invited men he knew and trusted, or at least men of influence who he felt could

work together. They included Abram Piatt Andrew, assistant secretary of the

Treasury; Henry P. Davison, a business partner of Morgan's; Charles D. Norton,

president of the First National Bank of New York; Benjamin Strong,

another Morgan friend and the head of Bankers Trust; Frank A. Vanderlip, president of the National City Bank; and Paul

M. Warburg, a partner in Kuhn, Loeb & Co. and a Jewish German

citizen. From the 1920s on Warburg intensified his determined interest in

Zionism in Palestina.

The men made their way to secretive

Jekyll island by their elitist private railway cars

and ferries. Their descendants are today's GOLDMAN SACHS.

Obama's

Secretary of the Interior Sally Jewell spoke at the Ducks Unlimited [DU] National Convention. She had

previously worked 40 years for BIG private industries experience ranging from

General Electric and Mobil Oil to the banking industry and REI.

Currently, 45% of Ducks Unlimited special interest lobby national budget comes

from the government.

Click

below for Interior Secretary for Obama shills at DU convention for Army Corps

of Engineers, Big MegaBusiness & Ducks Unlimited

for the uber elite wealthy class

Guess which lady worked for one of the world’s LARGEST MITIGATION BANKS

By Steve Horn • Monday, August 29, 2016

http://www.desmogblog.com/2016/08/29/dakota-access-pipeline-tribal-liaison-army-corps-engineers

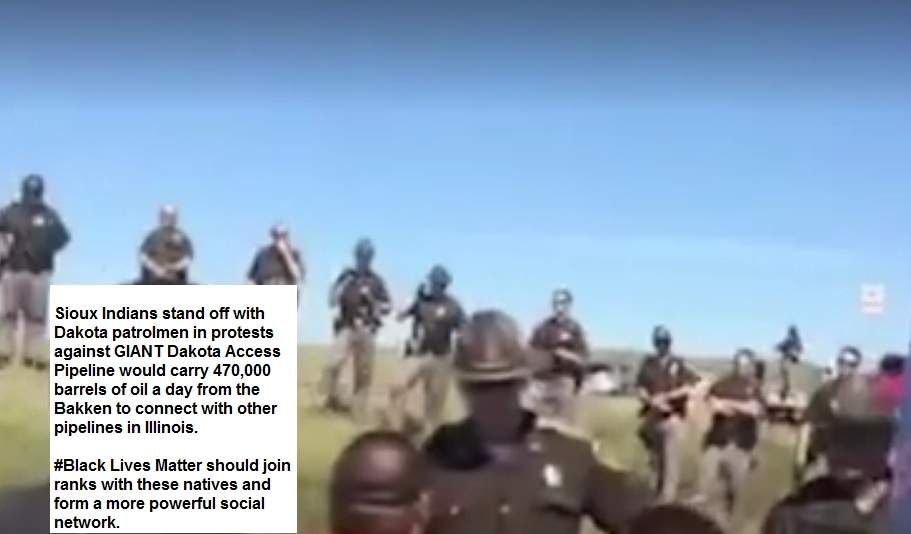

At issue here in Standing Rock Sioux Tribe v. U.S. Army Corps of Engineers, then, is the alleged lack of thoroughness of the Section 106 review and not the absence of one altogether. Even the Advisory Council on Historic Preservation (ACHP) itself penned a letter in May 2016 to the Corps expressing concern about the lack of rigor in its Section 106 Review. Like the southern leg of TransCanada's Keystone XL pipeline and Enbridge's Flanagan South pipelines, the Army Corps and Dakota Access LLC by extension utilized Nationwide Permit 12 as an end-run around a more vigorous and NEPA-oriented environmental review. A review of court documents for the case currently unfolding in the U.S. District Court in Washington, D.C. has revealed that the tribal liaison for Energy Transfer Partners tasked with abiding by Section 106 passed through the revolving door and formerly worked for the Army Corps. The finding also raises key ethical questions in the field of archaeology. That liaison — Michelle Dippel — technically works for a Dakota Access LLC contractor named HDR, a company which helps pipeline companies and other oil and gas industry infrastructure companies secure permits for their projects. Dippel, the South Central Region Environmental Services Lead for HDR, began her career as a project manager for the Army Corps' Fort Worth District and also formerly worked for the natural gas pipeline company Spectra Energy. An archaeologist by academic training and a member of the Register of Professional Archaeologists, a biographical sketch for Dippel tracked down on the Florida Department of Transportation's website lists her job sub-title as “Project Streamlining” on behalf of the DOT. Dippel lists Section 106 consultation as an area of expertise on her LinkedIn page. Section 106, in turn, serves as a major part of the focus of the lawsuit, the recently completed occupation of a Dakota Access Pipeline construction site in Cannon Ball, North Dakota, and the push by the Standing Rock Indian Reservation for a court-ordered injunction to halt pipeline instruction. “Although federal law requires the Corps of Engineers to consult with the tribe about its sovereign interests, permits for the project were approved and construction began without meaningful consultation.”

This growing Native American standoff with Dakota Access is the last Great Indian War. "This is the first time the seven bands of the Sioux have come together since Little Bighorn," one of the Indian activists said. More than 80 different tribes are camped in the area. On September 9th a watershed decision will be made regarding the Red Warrior Camp and its large number of protesters, the camps growing as spontaneously as Woodstock Music Festival, long ago, but this time for Native Indians and not Vietnamese internally displaced peoples [IDPs]. A federal court will decide if the Dakota Access pipeline should proceed, or be halted for more environmental and archaeological assessments.

Independent

Researcher

March 1, 2016

Environmental

Law Reporter, Vol. 46, 2016

Abstract:

The Clean Water Act aims to

restore and maintain the integrity of U.S. waters, which include wetlands —

those land forms once referred to as swamps, bogs, prairie potholes, or some

other negatively connoted term. Wetlands are ecologically and economically

important. The federal regime for protecting them, however, has failed its

pursuit of “no net loss” of wetlands. Mitigation banking has become the

preferred mechanism for mitigating wetlands loss, despite repeated studies

showing mitigation banks fail to replace the lost natural ecosystems. This

paper explores the complex wetlands protection regime in the United States,

then compares results in steady-state Ohio wetlands, a best case scenario for

mitigation banking, with the nation’s largest (and most at risk) wetlands —

those on Louisiana’s coast. It concludes that mitigation banking on Louisiana’s

coast is likely to result in massive destruction and loss of the fragile

coastal ecosystem.

Secretary of the Interior Sally Jewell spoke at the Ducks Unlimited [DU] National Convention. She had previously worked 40 years for BIG private industries experience ranging from General Electric and Mobil Oil to the banking industry and REI, Currently, 45% of DU’s national budget comes from the government.

Interior secretary speaks at DU convention

FORBE’S

magazine writes:

“ ‘Mitigation

banks,’ are overseen by the Army Corp of Engineers, to finance wetlands

restoration. By restoring wetlands, these banks create credits that developers,

private and public, can buy to offset damage to wetlands caused by their

projects. Because the system speeds the approval process — and time is money —

developers are willing, if not happy, to buy mitigation credits. The developer

payments in turn repay the private investors who front the money for banks’

restoration work. In the decades since the first commercial mitigation bank

application in 1991, more than 1,900 mitigation banks have been established. By

2008, between $1.1 and $1.8 billion was being spent to restore functioning

wetlands annually, protecting approximately 24,000 acres per year. Despite

these gains, this approach is not a panacea; the loss of wetlands is still

occurring at a significant rate. These losses are due to a number of different

factors, including large-scale erosion and rising sea levels, particularly

along coastal areas. These [mitigation

banks] markets have gotten considerably more transaction friendly in their

20-year existence”

With its headquarters in a high-rent Washington, DC, commercial district just three blocks from the White House, Ducks Unlimited has resources that dwarf those of most of their opponents. A visit to DU’s website also reveals an organization whose agenda goes far beyond its stated interest of preserving habitat for waterfowl. For example, DU has tied its interests in wetlands to many Mitigation Bank complicated deals, and to the global warming/climate change issues.

Wetlands of the United States are often defined by the United States Army Corps of Engineers [USACE or CoE] and the United States Environmental Protection Agency [EPA] and many times caught in the interplay of the U.S. Fish & Wildlife Service, which is a branch of the Department of Interior, the department which had in frontier days squeezed native American Indians onto smaller and smaller reservations, and which has much to do today with nuclear materials mining for the nuclear war and energy and nuke subs programs of the U.S. https://www.doi.gov/ocl/hearings/110/AbandonedMineLands_031208Wetlands

America Trust [WAT], is a major supporting entity to Ducks

Unlimited (DU). They are in a lawsuit in

Virginia in which vintners and grape farmers are quacking like alpha male ducks

against Ducks Unlimited/WAT. In a 29-page decision handed down by the Twentieth

Circuit Court of Virginia on June 19, 2014, Judge Burke McCahill ruled overwhelmingly in favor of Jennifer

McCloud’s Chrysalis

winery and AGAINST Ducks

Unlimited/WAT. Since then, using

their federal government insider’s expansive and unlimited pull, the Chrysalis’s

victory in court is now under challenge by six regional and national land

trusts: The Nature Conservancy, The Virginia Conservancy, The Civil War Trust,

The Land Trust Alliance, The National Trust for

Historic Preservation, and The Piedmont Environmental Council. In April

2015, the groups petitioned the Virginia Supreme Court to allow them to weigh

in on the case and they have filed an Amicus Brief in support of Wetlands

America Trust/Ducks Unlimited.

http://www.cfact.org/2015/06/26/ducks-unlimited-virginia-winery-face-off-in-court-oer-land-use-restrictions/

Ducks Unlimited is essentially a Washington DC lobby

group that somehow gets entangled with many Army Corps of Engineers wetlands

deals, involving unknown secrecy-laced MITIGATION BANKS, and developers. A lot of the ‘duck hunters’ who work in the

DC lobby headquarters are rich Republican types whose “ancestors came to

America on the Mayflower, at Plymouth Rock”, etc. Remember when Dick Cheney shot up with buckshot

[“peppered”] in 2006 his Texas bird hunting friend, Harry Whittington, another privileged

white shoe attorney?

Texas lawyer shot in the face by Dick Cheney apologizes to Cheney on national news for stupidly putting his head in the nozzle of the former Freemason Grandmaster's shotgun!

Old long ago 2005 flash! Even CHEVRON, not well known for

eco-friendliness, has opened its own Wetlands Mitigation Bank! Will Mother Nature put on her wedding gown

and marry this groom bearing chevrons? http://www.ecosystemmarketplace.com/articles/chevron-opens-mitigation-bank-in-paradis-e/

“Despite the multimillion-dollar

profit Chevron anticipates from its mitigation

bank, corporate involvement remains rare in the numerous ecosystem-service

markets that have begun evolving. But in the field of mitigation banking, their ranks are growing. Wetland mitigation

banking, which began in the early 1990s, now counts up to 2000 approved banks

throughout the United States and an additional 198 in the proposal stage according to an inventory

completed last year by the Army Corps of

Engineers. Between 20 and 30 percent of them are backed by large

corporations, says Rich Mogensen, immediate past

president of the Mitigation Bankers Association and director of Mid-Atlantic

Mitigation LLC, an EarthMark Company. Corporations dabbling in mitigation banking are predominantly energy or pipeline companies such as

Chevron, Tenneco and Florida Power

and Light; corporations that are financially secure, have extra land and

are looking for ways to diversify. Similar to the Paradis

property, the land converted into wetland banks typically had a previous

history as a site for oil exploration but no longer has any mineral value.”

http://www.fishingbuddy.com/ducks-unlimited-opinions

http://farmprogress.com/blogs-grain-growers-fires-off-complaint-ducks-unlimited-9041

http://www.duckhuntingchat.com/forum/viewtopic.php?f=4&t=76699&start=50

Measure 5, which DU is promoting in North Dakota to the annoyance of local

farmers

http://www.grandforksherald.com/content/national-resources-conservation-service-defends-ducks-unlimited-work-nd-wetlands “Where’s the plan? This is $4.5 billion of

your money, and no one has told you where one dime of it is going. Would you do

that? We wouldn’t.” He said money goes to an out-of-state political

organization.

Update:

http://www.dailyfreeman.com/article/DF/20110525/NEWS/305259980

DU covers up 130 acres rather than the

legal state limit of 5 acres at former New York

State Galeville Air Base

MEMPHIS – September 18, 2015 http://www.ducks.org/conservation/du-wetland-mitigation/ducks-unlimited-enters-mitigation-banking-business

Alberta

Canada experts frown upon transparency and sincerity of DUCKS UNLIMITED

THE HARBINGER -- Full

Service Banks for the Environment -- Developers Buy Credit from Mitigation

Banks to Destroy Wetlands --

by Bill Patterson https://www.angelfire.com/electronic2/haarpmicrowaves/MITIGATION-BANKS.html

2016 -- 'Stand with the Standing Rock Sioux, facing both arrest and a financial lawsuit -- for opposing the WETLAND-cidal Texas-based Big Carbon firm DAKOTA ACCESS as it begins construction of its great "Black Snake" of OIL DYNASTY FAMILIES COMBINED greed to carry fracked oil from the Bakken fields through the Dakotas and Iowa to Illinois....This is the real struggle. ' http://indiancountrytodaymedianetwork.com/2016/08/15/dakota-access-pipeline-standoff-mni-wiconi-water-life-165470

Dakota Access Pipeline Standoff: WATER IS LIFE!

-- Dakota Access pipeline: MANY arrested, including Standing Rock

Sioux Chairman David Archambault II, as protests heat up. INDIANCOUNTRYTODAYMEDIANETWORK.COM

Additional Front Line Coverage by PAUL STREET

It will be quite hard to cut off the head of the Black Snake, protected by Army Corps of Engineers, same agency that built the levies of New Orleans that 'stood up so well' during Hurricane Katrina. The USACE is very invested not only in oil and uranium, but WATER and WETLANDS [in wetlands issues along with their clubby executive level cohorts at 'Ducks Unlimited' NGO--Ducks Unlimited members tend to vote Republican)]. Check out all the smoke and mirrors hidden details of the billions industry of Wetlands Mitigation Banking, it is rarely in the news. http://www.nww.usace.army.mil/Business-With-Us/Regulatory-Division/Mitigation-Banks/

Walla Walla District, U.S. Army Corps of Engineers, NWW.USACE.ARMY.MIL

http://www.ecosystemmarketplace.com/articles/bankers-developers-environmentalists-weigh-in-on-new-wetlands-regulation/ Ducks Unlimited [DU], is a world leader in wetlands 'in-lieu-fee' mitigation bank provider related services. There have been lots of cases in the past where money was provided but wetlands were never mitigated. That's a problem with enforcing accountability, a problem with the Army Corps of Engineers." Until now, adds Mr. White from Defenders of Wildlife, "no one was watching the farm."

Bankers, Developers & Environmentalists Weigh In On New Wetlands Regulation -…

ECOSYSTEMMARKETPLACE.COM

http://corpslakes.usace.army.mil/part.../action-drill.cfm...

Ducks Unlimited [DU] and the U.S. Army Corps of Engineers [CoE] signed many collaborative efforts in their quite cozy relationships. Partnerships: Partnership Success Stories

Story: On 24 September 2003, Ducks Unlimited and the U.S. Army Corps of Engineers signed a collaborative effort to improve waterfowl management within the Askew Management Area near Arkabutla Lake. Under the new partnership, entitled the Askew Wildlife Management Area Site Specific Agreement No. US-...

http://corpslakes.usace.army.mil/partners/action-drill.cfm?GID=48

Secretary of the Interior Sally Jewell spoke at the Ducks Unlimited [DU] National Convention. She had previously worked 40 years for BIG private industries experience ranging from General Electric and Mobil Oil to the banking industry and REI, Currently, 45% of DU’s national budget comes from the government.

Sept.

2012, Bureaucratic Slippage and Environmental Offset Policies: The Case of Wetland

Management in Alberta, Shari Clare & Naomi Krogman

-- http://www.tandfonline.com/doi/abs/10.1080/08941920.2013.779341?mobileUi=0&journalCode=usnr20

Bureaucratic

Slippage and Environmental Offset Policies: The Case of Wetland Management in

Alberta

Article

(PDF Available) in Society and Natural Resources 26(6) · June

2013 https://www.researchgate.net/publication/262970479_Bureaucratic_Slippage_and_Environmental_Offset_Policies_The_Case_of_Wetland_Management_in_Alberta

Abstract -- Environmental trading programs are

seen as promising tools for fostering sustainable development, yet little is

known about how decision-making practices in these emerging policy spaces

influence program outcomes. This study quantifies wetland compensation outcomes

in Alberta, Canada, and compares these outcomes to statements made in

government-issued compensation guidelines. Contrary to guideline intent, we

found a strong tendency to skip over wetland avoidance in favor of compensatory

payments for wetland loss; that compensation sites are frequently located

outside the watershed of impact; and that distances between impact and

compensation sites often exceed what is considered reasonable under the

guidelines, without commensurate increases in compensation ratios. Agency

capture was found to drive these implementation failures, and mechanisms

producing capture in this case include overhead governance and organizational

goal ambiguity. This study suggests that greater attention must be given to

agency context if environmental trading programs are to be effective tools for

managing environmental resources.

January 28, 2009|By

Gerry Smith, Chicago TRIBUNE REPORTER

Interior secretary speaks at DU convention

Old article from WASHINGTON POST reports on neo-reactionary GW stacked Supreme Court trashing a nearly 35 year old Water Act that formerly protected WETLANDS from parking lot developers and condo building maniacs... click here or DUCK for cover!

Old article from WASHINGTON POST reports on neo-reactionary GW stacked Supreme Court trashing a nearly 35 year old Water Act that formerly protected WETLANDS from parking lot developers and condo building maniacs... click here or DUCK for cover!

Eight state and federal

agencies were involved in the project, and all called it the largest and most

ambitious restoration of coastal wetlands in the history of California,

where 95 percent of saltwater marshes have been given over to development. The Bolsa Chica wetlands project is

at the fore of a new and evolving science, said Shirley S. Dettloff,

a leader of the conservation group Amigos de Bolsa Chica. “Not many wetlands have been restored in the world,

especially in an oil field,” Ms. Dettloff said. “Even

we locals sometimes forget that this was the second-largest functioning oil

field in the state of California for years, since the 1930’s.”

Developers

Buy Credit from Mitigation Banks to Destroy Wetlands,

by Bill Patterson

PALACIO WETLANDS BANK .... click here for helpful details....

National

Mitigation Banking Association, 107 S. West Street

#573 Alexandria, VA 22314 USA 202-457-8409 info@mitigationbanking.org Full Members:

Full membership comes with a full set of benefits to match. Mitigation Bankers, corporations and larger

NGOs enjoy the highest level of services and support with Full Membership. Annual Membership $5,500

Mitigation banking is becoming an

instrument of choice for mitigation alternatives. Objectives include:

• Replacement of the chemical, physical,

and biological function of wetlands and other aquatic resources.

•Providing flexibility for

applicants needing to comply with mitigation requirements.

•Consolidated, cost-effective

utilization and protection of resources.

Operating much like a commercial

lending institution, bank “credits” exist as acres or a unit that reflects the functional

value of that resource. Projects involving wetland impacts require debiting the

bank in an amount to compensate for functional losses. Mitigation banking is

particularly useful in compensating for small wetland impacts where on-site mitigation

is difficult to achieve and may not be an economical option. By concentrating

resources into large and potentially more valuable areas, functional benefits

can be realized, increased management control can be gained, and costs can be

reduced.

In

November 1995, EPA, the Corps of

Engineers, FWS, National Oceanic and Atmospheric Administration's [NOAA] National

Marine Fisheries Service, and U.S. Department of Agriculture's [USDA] Natural

Resources Conservation Service released the final Federal Guidance on the

Establishment, Use, and Operation of

Mitigation Banks. The guidance gave state agencies, local governments, and

the private sector the regulatory certainty and procedural framework they

needed to move forward on seeking approval to operate mitigation banks.

Following its issuance, banks proliferated across the country and became a

mainstream compensatory mitigation option.5 With the passage of the

Transportation Equity Act for the 21st Century (TEA-21) in 1998, banking became

the preferred compensatory mitigation alternative for impacts involving the

federal funding of transportation projects. Since 1998, conferences have been held annually devoted to sharing

and encouraging advances in mitigation

banking policy and practice.

[just a few below, the list is long, now almost 2000

mitigation banks]

·

ATKINS Mitigation Bank www.atkinsglobal.com/northamerica

·

Pineywoods Mitigation Bank. Largest in Texas

·

Bear Creek

Mitigation Bank, North Carolina

·

Petersen Ranch

Mitigation Bank -- the largest mitigation bank in California at more than 4,000

acres

·

Katy

Prairie Stream Mitigation Bank (KPSMB)-- the largest permitted stream mitigation bank in the

United States.

·

Mitigation

Marketing, the first and largest firm specializing in

marketing support for mitigation banks in Florida-- The mitigation bank is

owned and operated by Miami Corporation, headquartered in Chicago.

·

Farmton

Mitigation Bank

·

Greens

Bayou Wetlands Mitigation Bank-- In 2014, a new

Mitigation Banking Instrument (MBI) significantly changed the bank's service

area for all subdivisions, while permitting additional mitigation credits in

the newest Subdivision C. The new MBI also incorporates a new credit

calculation.

·

Rockin' K on Chambers Creek

Mitigation Bank (RKMB)

November 26, 2014 | by Rob

Port

https://www.sayanythingblog.com/entry/ducks-unlimited-probably-find-new-leadership-north-dakota/ If groups like Ducks Unlimited were smart, they’d move personnel like Steve Adair far from North Dakota where their ill-advised activism has made them pariah’s with North Dakotans. Few ND policymakers are interested in continuing any sort of a policy discussion with the likes of Steve Adair. To allow the federal government to use these DUCKS UNLIMITED employees as their “boots on the ground” in the state of North Dakota is unfair to every farmer, and the entire agricultural industry, in North Dakota. Even more discouraging is Ducks Unlimited’s support of Measure 5. Currently, 45% of DU’s national budget comes from the government. If Measure 5 passes, North Dakota DU will now have the opportunity to apply for even more grants!

Well Over 1/3 of

Teamsters Union members are illegal immigrants

This has been the reality for over 25 years

now.

For

the Teamsters, an undocumented worker and a blue-collar worker are often the

same thing. Over a third of its members are illegal immigrants. The union,

which represents a variety of workers, from truck drivers to airline employees,

doesn’t ask about immigration status, but president

George Miranda estimates many of them are undocumented.

https://qz.com/1207572/new-yorks-sanctuary-union-is-fighting-for-undocumented-workers/

History of US government

breaking INDIAN TREATIES

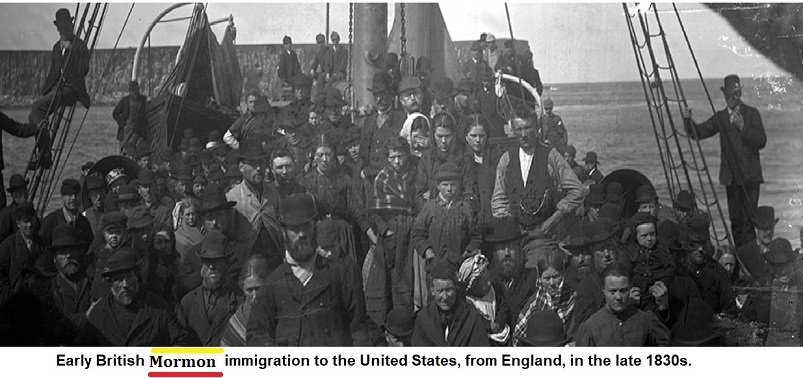

The

first Quaker and Huguenot and Sephardic European Jewish and Mormon settlers in

USA, 1600s to WW1, many of them slave-traders and/or slave owners, did NOT

embrace the native indigenous Indian races in Colonial America. In fact they were quite the opposite and many

of them believed in the DOCTRINE OF DIVINE DISCOVERY. The myth of THANKSGIVING DAY and shared

cookouts and love fests is just ONE BIG TURKEY. The oldest standing Mormon

chapel in the world is Gadfield Elm Chapel near the village of Pendock in

Worcestershire, England, dated 1836.

The

native tribes numbered around 60 million at the time of the Mayflower bringing

Puritan extremist pilgrims to the shores of the Native Tribes Continent. By the end of the 1800s that number had been

reduced to under 750,000, and as a character declared

in Coppola’s APOCALYPSE NOW, it was done “with extreme prejudice”.

· 8 Million Aroaks alone were exterminated

by Columbus and his descendants in the New World. Even by 1650 “New Englanders” were scalping

and slaughtering native peoples.

· Much like the Mongolian Golden Hordes of

Genghis Khan, and like the Viking Savage Raids in Dark Ages Europe, the

settlers of America supported a large subgroup of brutal exterminators of both

Native Indians and their buffalo herds.

In 1862 was the notorious MANKATO MASSACRE of Native family villages, en

masse. The Gold Rush of 1849 was in

large part a PR stunt, to drive away and/or wipe out millions more natives from

their lands.

· 1868 – just two years after the end of

the Civil War in the States, the 2nd TREATY OF FORT LARAMIE was drafted. 1871

was the beginning of the extensive Buffalo Slaughter Campaign to starve out the

Indians (it was common practice to kill all the horses of captured Indian

villages also, those which could not be used by colonial Rangers). In 1873 already, huge mountains of buffalo

skulls poxed the New American West, more than 1.5

million buffalos massacred in one year alone.

In 1874 General Custer began his PR “run” of “Gold discovered in Sioux

Black Hills Territories!” Col. McKinsey

soon declared afterwards a TOTAL WAR against indigenous peoples. Many Indian chiefs joined Freemason lodges

just to survive, taking orders from their new Brothers and often becoming Grand

Master of a new native lodge.

· 1880s—both dominant Protestant and

minority Catholic efforts to steal and raise Indian children into Christianity.

· 1887 – The General Allotment Act of

Congress, very anti-Indian.

· 1903 – the U.S. Supreme Court gives

Congress unlimited authority to break all Indian treaties.

· 1960s – Sterilization of Lakota Indian

Women Program followed by Pine Ridge and Wounded Knee uprisings.

LABOR

HISTORY OF U.S. around this same time as Pine Ridge Uprising ….

* 1962 – Federal Employees win

first time COLLECTIVE BARGAINING, signed by JFK into law. Legal to “bargain” but

illegal to “strike”.

* 1968 – Memphis Black

Sanitation Workers Strike (AFSCME)

* 1970 – The Great Postal

Strike in 15 US states

*

1979 – Wage DECLINES begin and persists till today, 2018

* 1981 – PATCO Air Traffic

Controllers Strike, obliterated by Reagan

* 1984 – Minnesota Nurses

Strike

* 1991-95 – The Teamsters Ron

Carey acquired a fair amount of influence within the AFL-CIO, since they had

readmitted the Teamsters in 1985. Carey was close with the new leadership

elected in 1995, particularly Richard Trumka of the

United Mine Workers of America, who became Secretary-Treasurer of the AFL-CIO

under John Sweeney. Carey had also swung the Teamsters support behind the

Democratic Party, a change from past administrations that had supported the

Republican Party. The new Teamsters administration set out to break from the

past making energetic efforts to head off a vote to oust the union as

representative of Northwest Airlines' flight attendants, negotiating a

breakthrough agreement covering carhaulers, and

supporting local strikes, such as the one against Diamond Walnut, to restore

the union's strength.

* 1997 – UPS strike (with

Teamsters assistance just before they sold out to recruiting illegal

immigrants)

* 1999 – AFL CIO defends

illegal immigrant labor replacing resident farm laborers

* 2005 – Teamsters and SEIU split from steaming

stench of AFL-CIO corruption despite all had ties to now sanitized organized

crime and lobbies and NED & State Dept. agents

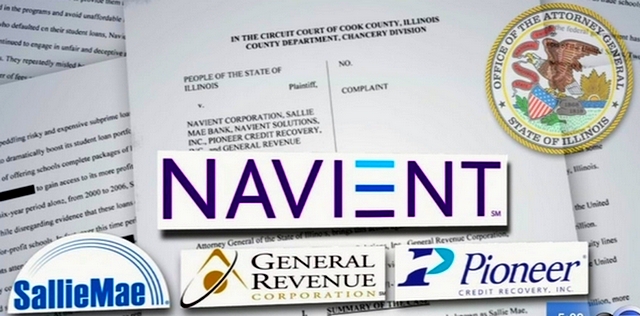

How U.S. university students are financially massacred much like the indigenous native peoples before them ..... SALLIE MAE-NAVIENT aka SLM Corp--

TRILLIONS DOLLARS SWINDLE BUBBLE

Just Waiting to Burst same as the Home Loan Mortgage Fannie Mae Swindles that

created CRASH OF 2008!

U.S.

universities have morphed into ONE BIG ATM CASH MACHINE mega-business SEEKING

foreign students, to the detriment of US students and future engineers and

computer programmers and IT specialists and software designers and nurses and

Physician Assistants, emerging from the giant womb of US legal resident

citizens and not recruited nor imported in from external factors OUTSIDE of the

domestic reality.

* U.S. Student loans that originate from Sallie Mae or

Navient are not federal loans. They are private loans. Sallie Mae and Navient offer few to no

options for repayment and do not offer any kind of income-based repayment

plans.

* Navient is Sallie Mae "rebranded":

don't be fooled by this PR stunt.

* No student loan is protected by bankruptcy—not

private loans, not federal loans, none of them. If you attempt to discharge

your loans in bankruptcy, there is a very high chance that your efforts will be

unsuccessful.

On September

17, 2010, it was announced that Sallie Mae will acquire federally insured loans

from Citigroup-owned Student Loan Corporation worth $28 billion. On Feb 25, 2014, Sallie Mae (aka SLM

Corp) announced the new name for the student loan side which will be called "Navient". Navient

now manages nearly $300 billion in student loans for more than 12 million customers, the company was formed in 2014 by the split of

Sallie Mae into two distinct entities, Sallie Mae Bank and Navient. It seems

around this time Sallie Mae sold off all her student loan assets and then

bought them back again under their new business name change to Navient, and

thereby avoided many lawsuits and prosecutions and it is the same ole same ole

Sallie Mae swindle and rake off that it was, but now with a face lift and name

change to NAVIENT. Already by In August 2015, the Consumer Financial Protection

Bureau sent Navient a letter telling its executives that the agency's

enforcement staff had found enough evidence to indicate the company violated

consumer protection laws. On May 28, 2015, the United States Department of

Justice announced that nearly 78,000 military service members would begin

receiving $60 million in compensation for being charged excess interest on

their student loans by Navient.

National

student loan debt has climbed to $1.4 trillion as of 2017

In June 2016, stockholders filed a class action lawsuit against Navient. The plaintiffs included Chicago police officers and retired city employees in Providence, Rhode Island. Up to 2017, already "tens of thousands" of complaints were filed against Navient. In 2017, 6,708 federal complaints were filed about the company, in addition to 4,185 private complaints – more than any other student loan lender in the history of the world.

The

Crony Capitalism of Sallie Mae, July 2013

https://reason.org/wp-content/uploads/files/sallie_mae_cronyism.pdf

How

SALLIE MAE (aka SLM Corp) College

Loans Got So Evil, a video

https://www.youtube.com/watch?v=pVKEsiNMPNc

July

2018 -- Navient, the Delaware-based student loan management corporation

formerly known as Sallie Mae, is being sued by California’s Attorney General

Xavier Becerra. In a suit filed Thursday, Becerra accused Navient,

the nation’s largest student loan servicer, of cheating thousands of borrowers

and forcing them to repay more than they owed. Becerra’s suit alleges that

borrowers were steered toward repayment plans that exceeded their income

levels, and that in some cases, Navient misrepresented how much borrowers

owed. When forced to pay more than they owed, many borrowers then defaulted on

their student loans. “By taking Navient to court, we’re sending a very strong

message that these practices will not be tolerated,” he said before the filing,

according to the San Francisco Chronicle.

National

student loan debt has climbed to $1.4 trillion as of 2017

In

February 2007, New York Attorney General’s office launched an investigation

into deceptive lending practices by student loan providers, including The College Board, EduCap, Nelnet, Citibank, and Sallie Mae.. On October 10, 2007, documents surfaced showing that

Sallie Mae was attempting to use the Freedom of Information Act to force

colleges to turn over students' personal information to unfriendly predatory

hands. The university involved was SUNY, State University of New York, which

declined the request and was forced to defend its position in court. In December 2007, a class action lawsuit was

brought against Sallie Mae in a Connecticut federal court alleging that SALLIE MAE discriminated against African American student loan

applicants by charging them much higher interest rates and fees. The

lawsuit also alleged that Sallie Mae failed to properly disclose profit gouging

terms in student loans to unsuspecting students. Finally, under the terms of a

settlement, Sallie Mae agreed to make a $500,000 donation to the United Negro

College Fund and the attorneys for the plaintiffs received a whopping and

handsome $1.8 million in attorneys' fees for being the erudite middlemen. (Wikipedia)

"ANONYMOUS" recommended websites:

DUCKS UNLIMITED

https://www.angelfire.com/electronic2/haarpmicrowaves/Ducks_Unlimited_2006.pdf

Reimportation

of Drugs, PhRMA & Tea Party

http://beaties_of_bulgaria.tripod.com/sandy.html

http://beaties_of_bulgaria.tripod.com/NGO-OBSERVER/The_NGO_OBSERVER.html

https://www.angelfire.com/electronic2/haarpmicrowaves/Varoufakis-NEVER-AGAIN.html

http://rebbe_rocky.tripod.com/Jon_Stewart_NED.htm

http://ikeya_zhang.tripod.com/NED-license-to-kill.html

https://www.angelfire.com/planet/blacklisting_central/Temp_Slaves.htm

How Illegal Immigration &

Fannie Mae Set Us Up for the CRASH of 2008

https://www.angelfire.com/planet/blacklisting_central/Adrian-2005-Report-Immigration.html

Trump’s Chabad/Hasidic

Stetson Hat Backers

http://rebbe_rocky.tripod.com/CHABAD_gangsta_ties_TRUMP.html

Rachel Maddow Rockets

for Israel family

http://rebbe_rocky.tripod.com/Rachel-Maddow-background.html

Synthetic Telepathy

& Elon Musk

http://carpathian_bronze.tripod.com/synthetic-telepathy.html

GROUND ZERO BOGUS

https://www.angelfire.com/zine/cetaceandragon/Ground-Zero-Conspiracy.html

SCAN of AISLING

http://boudiccaarran.tripod.com/aisling_bryan_adrian.html